Period Costs: Understanding Expenses Outside of Production

Grasping the difference between product and period costs serves as a financial compass for businesses. It’s like having a roadmap that guides accurate financial reporting, ensuring that the numbers on the balance sheet and income statement tell a clear and truthful story about the business’s health. Moreover, this understanding empowers businesses to manage costs effectively, making informed decisions https://x.com/BooksTimeInc about product pricing, production efficiency, and overall operational strategies.

Most Common Cost Accounting Formulas

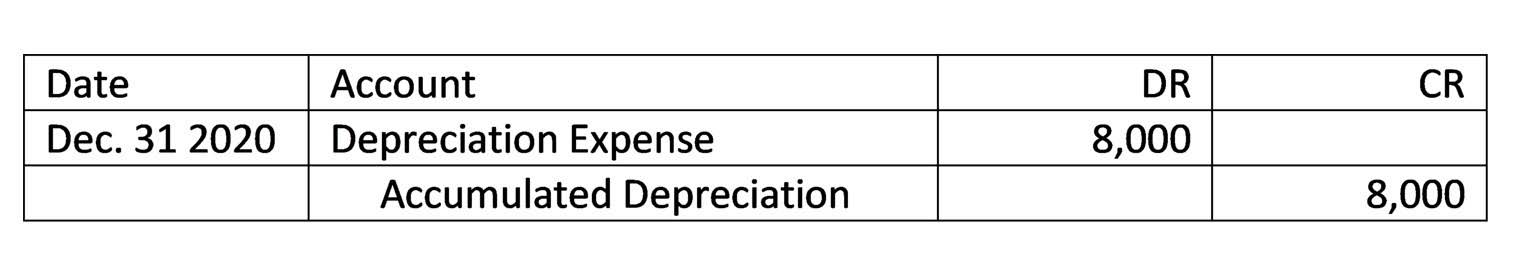

Similarly, managerial accounting provides useful financial information to managers for better decision-making. One of the areas within this branch includes cost accounting, which primarily focuses on costing techniques. Period costs are typically located on the income statement for the accounting period total period costs formula in which they are incurred. Prepaid expenses are reported on the income statement for the accounting period in which they are used or for when they expire. Period costs can be separated by category on the income statement to help understand what the costs are and how much is spent on each.

How confident are you in your long term financial plan?

The company’s period costs are $169,800 ($147,300 operating expenses + $500 interest expense + $22,000 tax expense). Operating expenses, like selling and administrative expenses, make up the bulk of your period costs. The management accountant must carefully evaluate the time expenditure to see if it will be included in the income statement. EVA https://www.bookstime.com/ is used to evaluate the financial performance and value creation of a company.

- These costs are related to activities such as advertising, sales commissions, and travel expenses for sales representatives.

- The Cost of Capital is used to evaluate the profitability and feasibility of investment projects and to make financing decisions.

- Usually, these costs come from various sources and accumulate into a single unit.

- It is essential to understand what product costs are before identifying period costs.

- Product costs are the expenses directly tied to the creation of goods or services within a business.

Accounting for Managers

- Production costs are usually part of the variable costs of business because the amount spent will vary in proportion to the amount produced.

- They analyze the cost of components, such as the processor, memory, display, and camera, to identify cost-saving opportunities.

- It is used to assess the financial impact of production, analyze cost trends, determine profitability, set prices, and make informed decisions regarding cost management and control.

- Fixed costs are different from variable costs, which fluctuate with changes in production or sales volume.

- COGM is calculated by adding the cost of direct materials used, direct labor costs incurred, and manufacturing overhead costs applied during the manufacturing process.

- Therefore, the Overhead Rate for this company is $10 per direct labor hour.

It measures the company’s ability to generate profit from its total assets. Direct Material Cost refers to the cost of the raw materials or components that are directly used in the production of a product. It includes the expenses incurred in acquiring, transporting, and storing the materials needed for manufacturing.

Following is the profit and loss statement of ABC Ltd, you are required to compute period expenses. The financial advisor advises them to take a loan from a recognized financial institution as they would charge a lower interest rate. It was estimated that a rate of 10% would be required to pay $5.4 million annually (simple interest rule) and which they could capitalize on in the initial year.

Accounting Test: Assessing Your Knowledge in Accounting Principles and Concepts

- For example, a furniture type that requires frequent machine setup and intricate quality inspections may have higher costs compared to one that has simpler production requirements.

- However, these costs are still paid every period, and so are booked as period costs.

- It’s important to note that the Predetermined Overhead Rate is an estimate and may differ from the actual overhead costs incurred.

- Product costs help businesses figure out how much it truly costs to make each item they sell, helping set prices for profit.

- Once the inventory is sold or otherwise disposed of, it is charged to the cost of goods sold on the income statement.

- Additionally, the formulation assists in streamlining processes by aligning expenses with the company’s financial objectives.

Then in upcoming years, they need to take the interest expense to profit and loss statement. Console ltd is planning for expansion in upcoming years, and for the same, they need to purchase machinery costing $54 million. But they are lacking funds now, and their stock price has touched a 52 week low. So they have hired a financial advisor who shall advise them on how to proceed upon the same that is getting funds and not impacting their stock price much. Access to detailed period cost data supports better operational and strategic decision-making. However, if these costs become excessive they can add significantly to total expenses and they should be monitored closely so managers can take action to reduce them when possible.

Production Volume Variance:

The direct labor costs for producing a set of chairs include the wages and benefits paid to the workers involved in the assembly and finishing processes, which amount to $500. This means that on average, it costs the company $200 to develop each software application. This information can be used to assess the cost efficiency of production, set pricing strategies, and evaluate the profitability of the software development activities. By mastering cost accounting formulas, you can gain valuable insights into important financial metrics like profit margins, revenue, and expenses. So whether you’re a seasoned accountant or just starting out, understanding cost accounting formulas is crucial for success.In cost accounting, various formulas are used to analyze and manage costs.

As there is no standard formula, professionals primarily rely on categorized expense identification and aggregation to compute this essential metric. Bringing an understanding of period and product costs to a value chain or break-even analysis helps you quickly identify what types of expenses are hampering your business’s profitability. Balancing product and period costs is important for your business performance efficiency. Product costs help you fine-tune the price of each item you sell, ensuring profitability. Period costs guide decisions about how to efficiently rule your small business realm to stay afloat, impacting staffing, advertising, and day-to-day operations.